what is considered income for child support in colorado

The minimum guideline amount for obligors earning less than 1500 per month shall not apply. What Is Considered Income.

Oklahoma Child Support Divorcenet

Calculation of the gross income of each parent gross income being income from any source other than child support payments public assistance a second job or a retirement plan.

. Adjusted gross income the child support obligation must be capped at twenty percent of the obligors adjusted gross income. How to Determine the Parents Incomes for a Child Support Calculation. Under Colorado Revised Statutes Section 14-10-115 a parents adjusted gross income refers to his or her gross income minus pre-existing child support and alimony obligations.

The following may be factored into the formula. Colorado does use the income share method to calculate child support. Contact the State Enforcement Unit of the CSS Program at 303 866-4323.

Non-custodial parents pay their share of child support to custodial parents. Colorado calculates child support using the Income Shares Model of support which is based on the gross income of both parents and general information about what intact families spend on their children. Wages including tips declared by the individual for purposes of reporting to the federal internal revenue service.

First of all the money you receive for child support may be considered income for specific purposes. Therefore the non-custodial parent pays 666 per month in child support or 666 of the total child support obligation. The noncustodial parents share of support sets the amount of the order.

How Child Support Amount is Determined. For example Colorado generally considers the interest earned on your IRA account to be income that should be included in the child support calculation. For example if the father earns 40000 per year and the mother earns 60000 per year combined 100000 per year then the father is responsible for 40 of the child support while the mother is responsible for 60 of the support.

The guidelines use a formula based on what the parents would have spent on the child had they not separated. You have three options. Gross income as it is defined by the statute and includes but is not limited to.

Contact the county child support caseworker handling your child support case. The Colorado Child Support Guidelines are designed to make sure that a fair share of each parents income and resources are given to their child. Other sources of unrealized income that the state may rule should be included are unrealized gains from unexercised stock options and retained earnings from corporations partnerships or sole proprietorships.

Most investment income is passive as opposed to wages salaries commissions and other forms of active income. Gross income before taxes of both parents. For example if you receive child support and public assistance your benefits may be reduced.

The legal definition of gross income for child support purposes found in CRS. Courts will use each parents gross income to calculate the child support amount. It is important to understand exactly what the law considers income when determining a child support award.

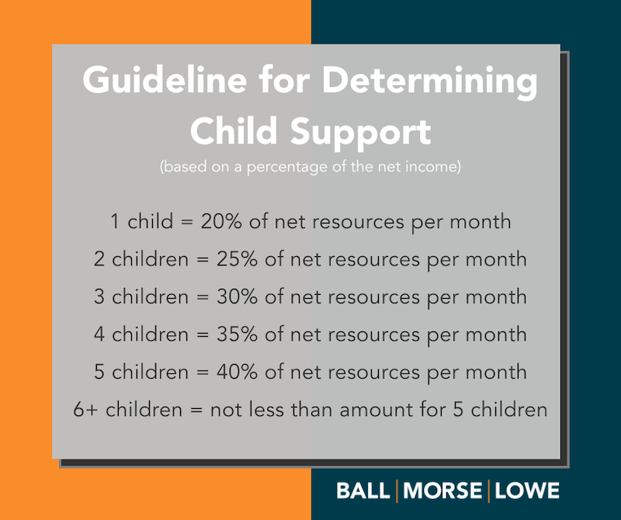

The starting point for determining the child support payments in Colorado is the pre-tax income of each parent. Depending on the circumstances it is possible for social security benefits retirement benefits loan proceeds and stock option sales proceeds to also be considered income in terms of child support. Child support is a percentage roughly 20 for 1 child and an additional 10 for each additional child of the combined gross income of the parents which is then split between both.

If you have any questions concerning how child support payments may affect your taxes contact our office for further information. 14-10-1155a includes many forms of income ordinarily considered investment income such as interest trust income annuities royalty payments. Much of the confusion of the definition of income in many states comes from the fact that state child support statues do not define exact inclusions for income.

Income can refer to more than just the wages. What is considered income for child support in colorado. The guidelines use a formula based on what the parents would have spent on the child had they not separated.

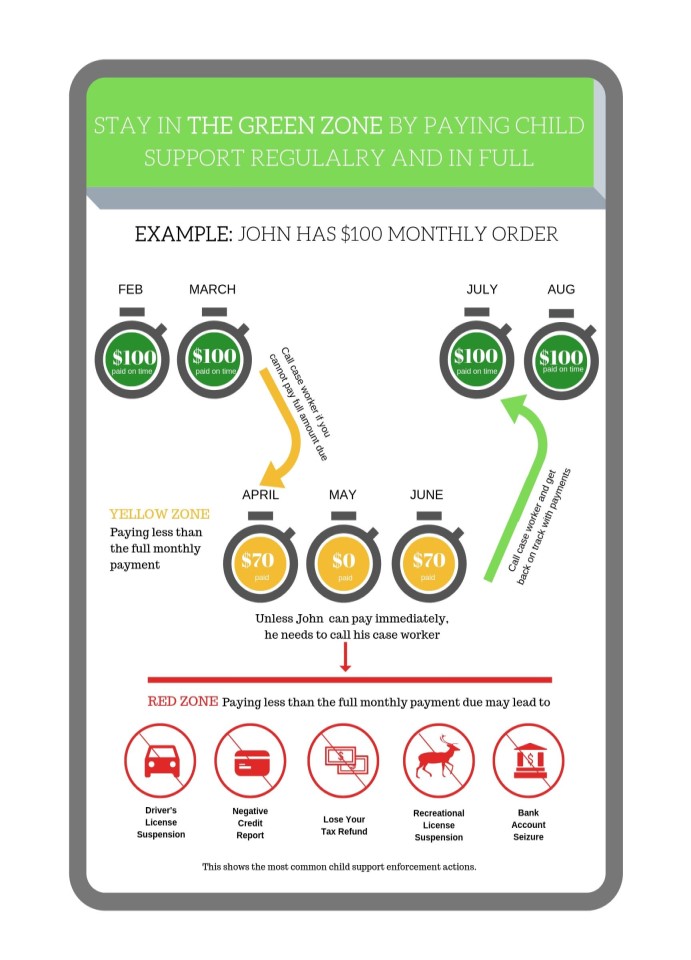

File a consumer dispute directly with the company who issued your credit report. The non-custodial parents income is 666 of the parents total combined income. As a non-custodial parent the one who cares for the child less than 50 of the time you will be required to pay child support to the other party the custodial parent.

For example if the father earns 40000 per year and the mother earns 60000 per year combined 100000 per year then the father is responsible for 40 of the child support while the mother. For more information on how child support is calculated see Child Support in Colorado.

How To Modify A Child Support Order In Colorado

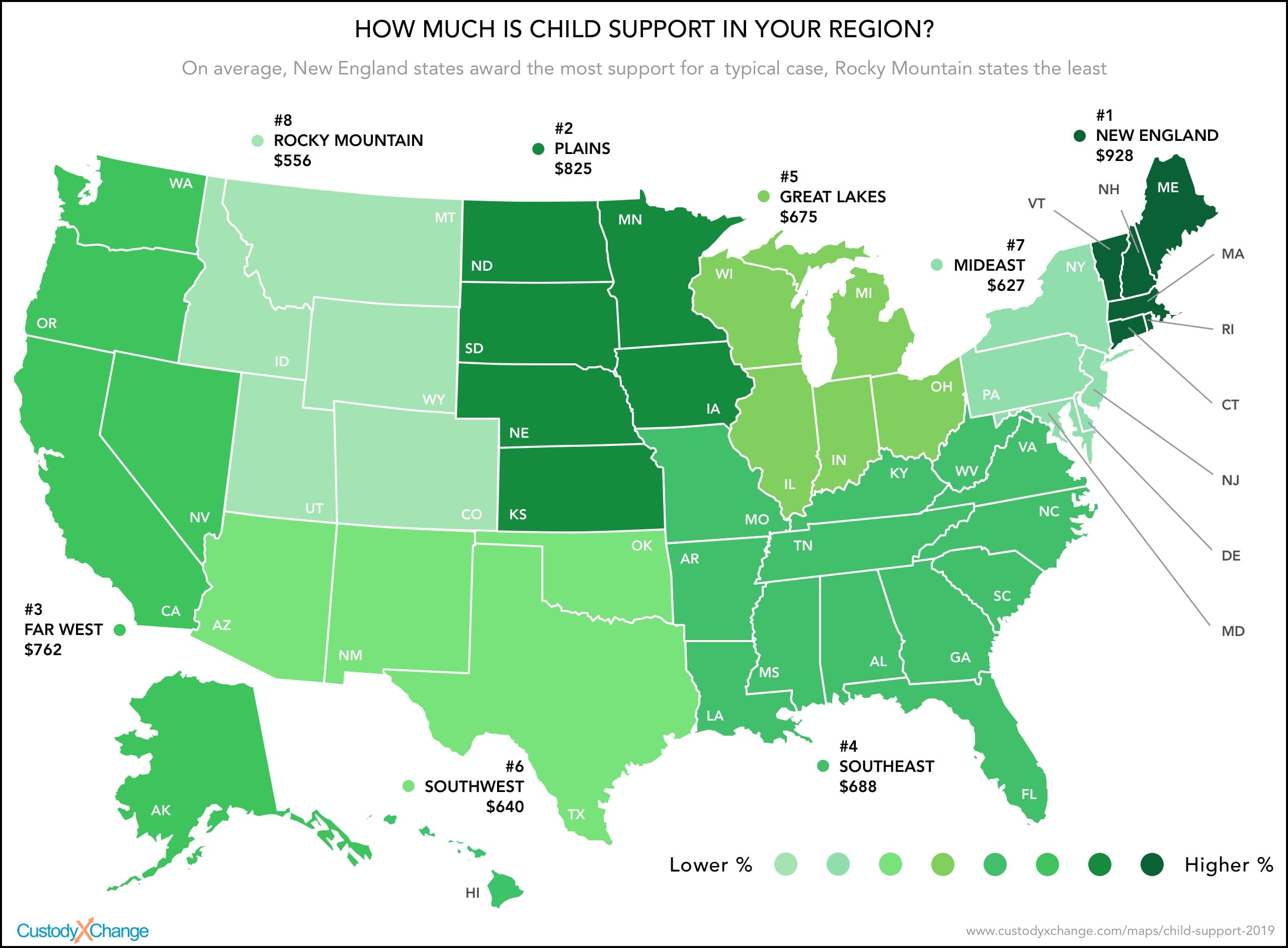

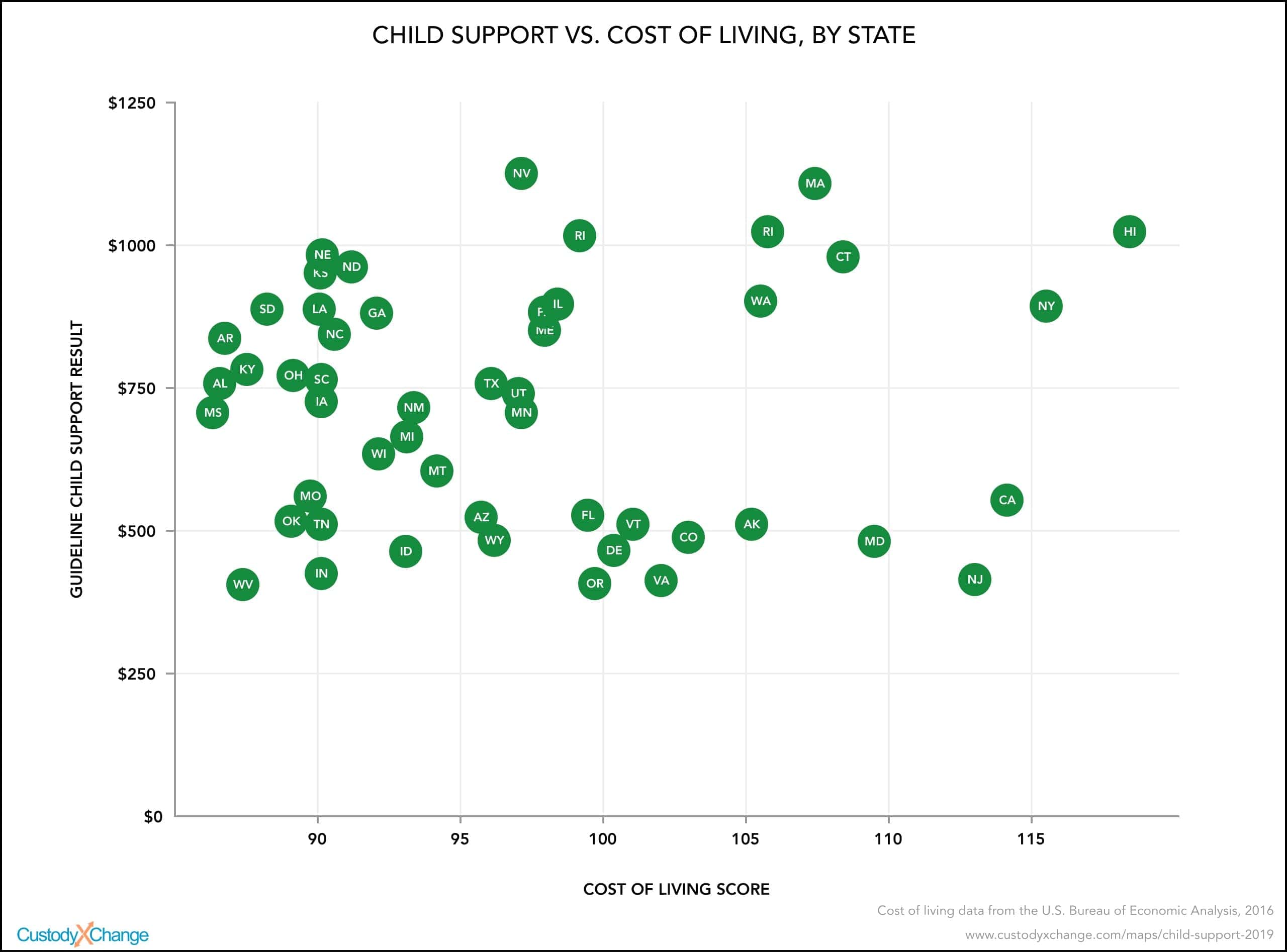

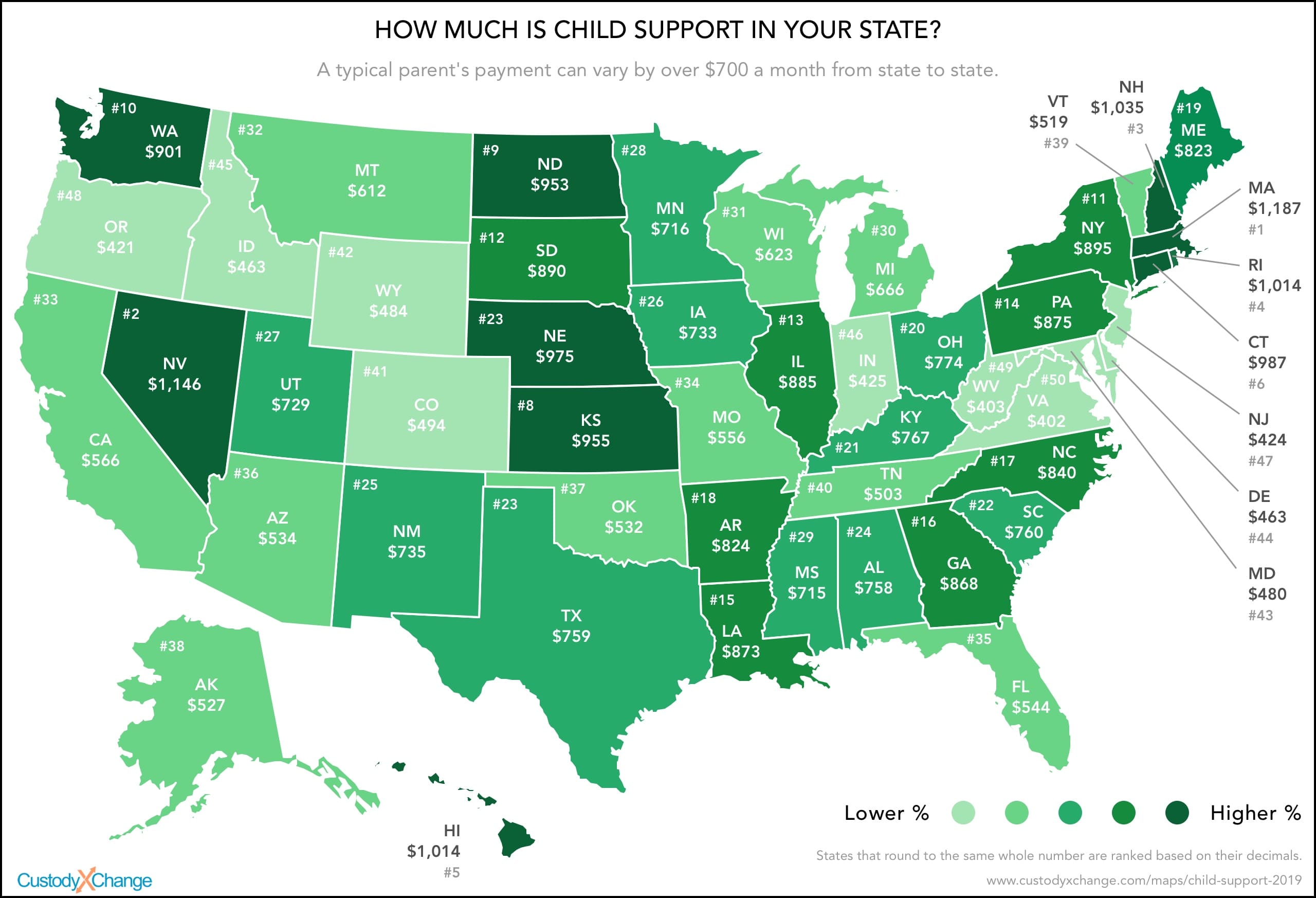

How Much Is Child Support In Your State Custody X Change

Child Support Financial Laws Responsibilities

Child Support An Essential Guide 2022

Child Support In Texas How It Works

Colorado Child Support Calculator 2022 Simple Timtab

Do I Need An Out Of State Attorney Dads Divorce Child Custody Spring Break Topeka

Child Support Modification Termination Colorado Family Law Guide

Get My Art Printed On Awesome Products Support Me At Redbubble Rbandme Https Www Redbubble Com I Sticker Creede Colorad State Flags Creede Creede Colorado

Emancipation For Colorado Child Support Colorado Family Law Guide

Child Support Basic Obligation Colorado Family Law Guide

Frequently Asked Questions Colorado Child Support Services

Do I Need A Lawyer For Child Support Findlaw

Enforcing Orders Colorado Child Support Services

Wyoming Child Support Computation Form Net Income Calculation Form Child Support Supportive Net Income

Does Child Support Increase If Salary Increases Goldman Law Llc

How Much Is Child Support In Your State Custody X Change